About Hiring Accountants

About Hiring Accountants

Blog Article

The Best Strategy To Use For Hiring Accountants

Table of ContentsOur Hiring Accountants DiariesA Biased View of Hiring AccountantsThe Greatest Guide To Hiring AccountantsNot known Incorrect Statements About Hiring Accountants Fascination About Hiring Accountants

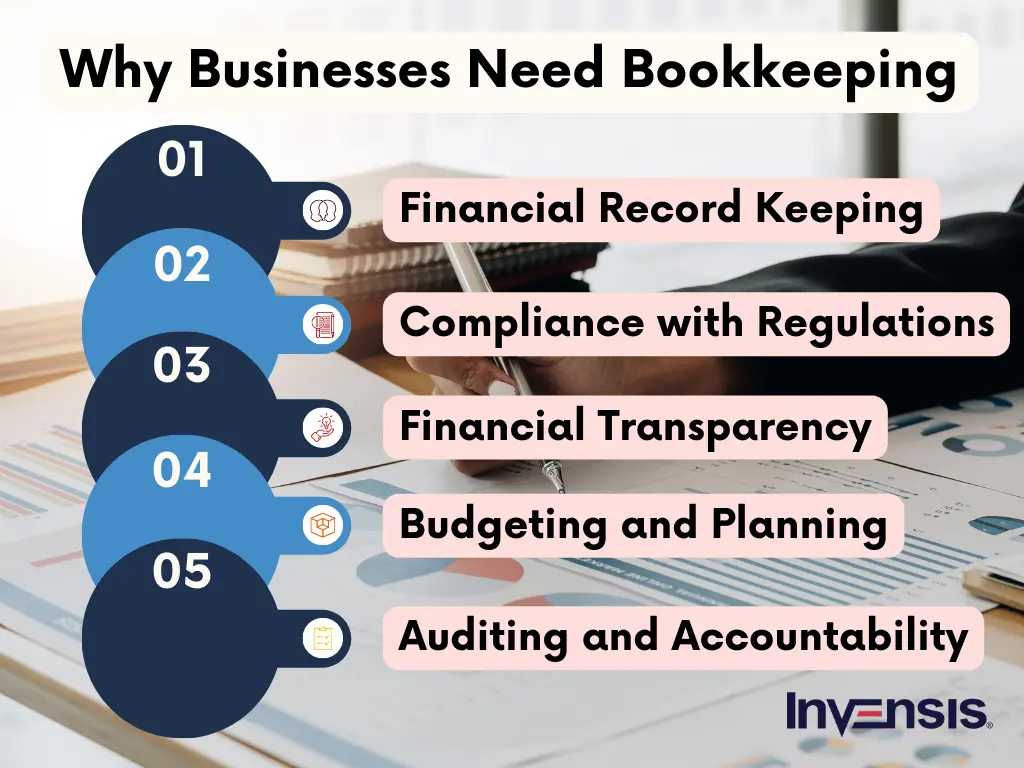

Is it time to employ an accounting professional? From simplifying your tax returns to assessing finances for enhanced success, an accountant can make a huge distinction for your service.An accounting professional, such as a state-licensed accountant (CPA), has actually specialized understanding in financial monitoring and tax obligation conformity. They stay up to date with ever-changing policies and ideal methods, making certain that your organization continues to be in compliance with lawful and regulatory needs. Their expertise allows them to browse complicated monetary matters and offer precise reputable suggestions tailored to your specific business demands.

They can also attach you with the ideal execution teams so you recognize you're setting everything up appropriately the very first time. For those that don't already have an accounting professional, it may be hard to recognize when to get to out to one - Hiring Accountants. Nevertheless, what is the oblique point? Every organization is different, however if you are encountering obstacles in the following areas, currently might be the best time to bring an accounting professional on board: You do not need to write a service strategy alone.

All about Hiring Accountants

The risks are high, and a professional accountant can help you obtain tax obligation recommendations and be prepared. Hiring Accountants. We advise speaking with an accountant or various other finance specialist concerning a number of tax-related objectives, consisting of: Tax obligation planning techniques. Gathering financial info for exact tax filing. Completing tax obligation forms. Making sure conformity with tax legislations and policies.

By dealing with an accountant, companies can strengthen their lending applications by giving extra accurate economic details and making a better instance for financial viability. Accounting professionals can also help with tasks such as preparing monetary files, analyzing monetary data to assess credit reliability, and creating a comprehensive, well-structured loan proposal. When things alter in your organization, you want to ensure you have a strong have a peek here take care of on your financial resources.

Are you all set to market your business? Accounting professionals can aid you determine your organization's value to aid you protect a reasonable deal.

How Hiring Accountants can Save You Time, Stress, and Money.

Individuals are not needed by legislation to maintain economic books and documents (organizations are), but refraining this can be a costly blunder from a monetary and tax obligation viewpoint. Your checking account and bank card statements may be wrong and you might not find this until it's too late to make corrections.

Whether you require an accounting professional will certainly probably rely on a couple of factors, including exactly how complicated your taxes are to file and the number of accounts you have to handle. This is a person who has training check these guys out (and likely an university degree) in audit and can handle accounting tasks. The per hour rate, which once again relies on location, task summary, and competence, for an independent accounting professional is regarding $35 per hour on average yet can be considerably a next lot more, equalize to $125 per hour.

An Unbiased View of Hiring Accountants

While a CPA can give bookkeeping solutions, this specialist may be too expensive for the task. For the tasks described at the beginning, a personal accountant is what you'll need.

It synchronizes with your bank account to simplify your individual finances. You can work with a bookkeeper to aid you get begun with your personal bookkeeping.

You decide to handle your individual bookkeeping, be sure to divide this from audit for any service you have.

The Ultimate Guide To Hiring Accountants

As tax period methods, individuals and businesses are faced with the perennial inquiry: Should I tackle my tax obligations alone or hire a professional accountant? While the appeal of saving money by doing it yourself might be appealing, there are compelling reasons to think about the expertise of a certified accounting professional. Here are the top reasons why hiring an accounting professional could be a wise investment compared to navigating the complicated world of tax obligations by yourself.

Tax obligations are intricate and ever-changing, and a skilled accountant remains abreast of these adjustments. Working with an accountant frees up your time, allowing you to concentrate on your personal or company activities.

Report this page